Tax Preparation Business Plan

You’ve come to the right place to create your Tax Preparation business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Tax Preparation businesses.

Below is a template to help you create each section of your Tax Preparation business plan.

Executive Summary

Business Overview

Denver Tax Services, Inc. is a new tax preparation company located in downtown Denver, Colorado. We help businesses and residents prepare their taxes and are trained to provide guidance and help for a variety of tax situations. We offer the best customer service in the industry and have a guarantee of accuracy or your money back. Clients who work with us will feel supported during every step of the tax prep and filing process.

Denver Tax Services, Inc. is run by Robert Schwartz. Robert is a certified tax professional and has decades of tax preparation experience under his belt. He has worked for several other firms (including H&R Block) and has provided his services to thousands of clients. His experience and professionalism has gained him a loyal clientbase. The combination of Robert’s expertise, experience, and clientbase will ensure that Denver Tax Services, Inc. is a success.

Product Offering

Denver Tax Services, Inc. provides guidance and support through every step of the tax preparation process. We help individuals and businesses get the maximum refund possible and file their taxes on their behalf. In addition to our tax preparation services, we also provide tax planning, business consulting, estate and trust tax preparation, audit support, and IRS representation services.

Customer Focus

Denver Tax Services, Inc. will help individuals and businesses located within 20 miles of the Denver area. We expect that most of the businesses that utilize our services will be small businesses that have less than 1,000 employees and earn less than $10 million in revenue per year. Most individuals who seek out our services will be middle class or affluent in order to have the disposable income to pay for our services.

Management Team

Denver Tax Services, Inc.’s most valuable asset is the expertise and experience of its founder, Robert Schwartz. Robert has been a certified tax professional for the past 20 years. Throughout his career, he has developed a loyal client base, with many clients having stated that they will switch to Denver Tax Services, Inc. once the company is established and running. Robert’s combination of skills, tax knowledge, and loyal following will ensure that Denver Tax Services, Inc. is a successful firm.

Success Factors

Denver Tax Services, Inc. will be able to achieve success by offering the following competitive advantages:

- Robert Schwartz already has a clientbase from his twenty years of experience working with other tax firms. This clientbase will help the company grow with their repeat business and by referring their friends and loved ones to our services.

- The company will emphasize providing client-focused service so that our clients feel valued.

- The company will provide our tax preparation services at a more affordable rate than the competition.

Download the Tax Preparation business plan template (including a customizable financial model) to your computer here <–

Financial Highlights

Denver Tax Services, Inc. is currently seeking $400,000 to launch. The funding will be dedicated to the office build out, purchase of initial equipment, working capital, marketing costs, and startup overhead expenses. The breakout of the funding is below:

- Office design/build: $100,000

- Office equipment, supplies, and materials: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $50,000

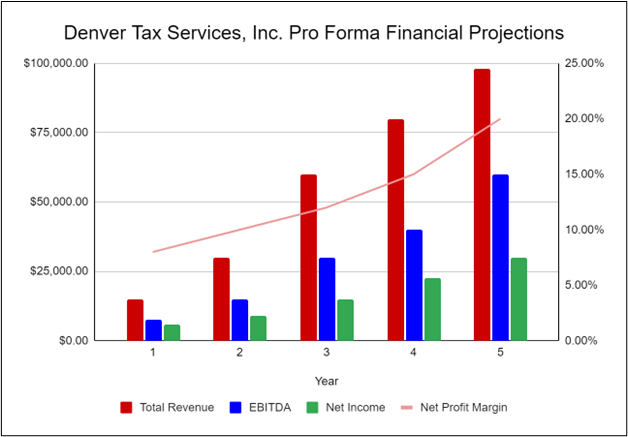

The following graph below outlines the pro forma financial projections for Denver Tax Services, Inc.

Company Overview

Who is Denver Tax Services, Inc.?

Denver Tax Services, Inc. helps the businesses and residents of Denver, Colorado with tax preparation and filing. We thoroughly analyze our clients’ tax situations to minimize their taxes and get them the biggest refund possible. We offer a guarantee of accuracy and will refund the fee for our services if our clients are not satisfied.

In addition to helping our clients with tax preparation and filing, we also provide a suite of other tax services, including tax planning, audit support, and IRS representation. We don’t want to just help our clients out during tax time. We want to support our clients throughout the year so they don’t get any surprises come April 15th.

Denver Tax Services, Inc. is run by Robert Schwartz. Robert has decades of tax prep experience and has gained a loyal clientbase from providing his services through competing firms. After working for several tax prep firms around town, he surveyed his clientbase to see if they would be willing to switch to his new company once launched. Most of his clients responded positively, which motivated Robert to finally launch his business.

Denver Tax Services, Inc.’s History

Upon surveying his clientbase and finding a potential office, Robert Schwartz incorporated Denver Tax Services, Inc. as an S-Corporation in July 2023.

The business is currently being run out of Robert’s home office, but once the lease on Denver Tax Services, Inc.’s office location is finalized, all operations will be run from there.

Since incorporation, Denver Tax Services, Inc. has achieved the following milestones:

- Found an office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

Denver Tax Services, Inc.’s Services

Denver Tax Services, Inc.’s mission is to maximize the tax refunds of all of our clients. To do this, we help our clients through every step of the tax return process and analyze every situation to make sure each client is getting as many deductions as possible. We help our clients minimize their taxes as much as possible during tax time and provide guidance on how to minimize taxes for the following year.

In addition to tax preparation and filing, we also provide the following services:

- Tax planning

- Business consulting

- Estate and trust tax preparation

- Audit support

- IRS representation

Industry Analysis

Taxes are one of the few certainties in life. However, tax time can be one of the most confusing and stressful times of the year for Americans. As such, many Americans seek out tax preparation software or tax professionals to help them with their tax returns every year. Due to tax law becoming increasingly complicated, the tax preparation industry has become an essential industry for the American economy. As such, the industry is expected to thrive for the foreseeable future.

The tax preparation industry helps citizens and businesses make sense of their tax returns to minimize their taxes and maximize their deductions. These professionals go through every applicable tax form and ask about every possible situation to ensure that customers are getting the biggest refund possible. In addition to tax preparation and filing, these companies also provide a full suite of other tax services, such as planning, consultation, and audit support.

According to IBIS World, the tax preparation industry has been growing steadily at a CAGR of 4.3% for the past several years. The demand for these services only continues to grow as tax law becomes more complicated. Therefore, this growth is expected to continue, meaning that Denver Tax Services, Inc. can expect to be successful in the following years.

Download the Tax Preparation business plan template (including a customizable financial model) to your computer here <–

Customer Analysis

Demographic Profile of Target Market

Denver Tax Services, Inc. will help individuals and businesses located within 20 miles of the Denver area. We expect that most of the businesses that utilize our services will be small businesses that have less than 1,000 employees and earn less than $10 million in revenue per year. Most individuals who seek out our services will be middle class or affluent in order to have the disposable income to pay for our services.

The demographics of Denver, Colorado are as follows:

| Total | Percent | |

|---|---|---|

| Total population | 1,680,988 | 100% |

| Male | 838,675 | 49.9% |

| Female | 842,313 | 50.1% |

| 20 to 24 years | 114,872 | 6.8% |

| 25 to 34 years | 273,588 | 16.3% |

| 35 to 44 years | 235,946 | 14.0% |

| 45 to 54 years | 210,256 | 12.5% |

| 55 to 59 years | 105,057 | 6.2% |

| 60 to 64 years | 87,484 | 5.2% |

| 65 to 74 years | 116,878 | 7.0% |

| 75 to 84 years | 52,524 | 3.1% |

Customer Segmentation

Denver Tax Services, Inc. will primarily target the following customer profiles:

- Small and medium-sized businesses

- Middle class residents and families

- Affluent residents and families

Competitive Analysis

Direct and Indirect Competitors

Denver Tax Services, Inc. will face competition from other companies with similar business profiles. A description of each competitor company is below.

H&R Block

H&R Block has been a king in the tax prep industry for several decades. With thousands of locations around the country and thousands of professionals available online, customers of H&R Block can get the tax prep and guidance they need with ease. H&R Block offers software and online tax prep services but also has in person services for those who would rather work with a professional. H&R Block has several offices in the Denver area, so we expect them to be a major competitor.

TurboTax

TurboTax is the most popular tax preparation service in the market. TurboTax provides easy- to-use software so the average American can file their taxes with ease. For those that have more complicated tax situations, TurboTax also offers consultations with tax professionals for an additional fee. Whether customers are doing their taxes on their own or with a professional, TurboTax provides all the support they need to make tax filing a smooth process.

Though TurboTax will continue to be popular, the company’s reputation has tarnished in recent years. The company has been sued several times for misleading their customers and lying about their pricing. These practices have made TurboTax untrustworthy. As such, many former customers of TurboTax will be eager to get the help of a local and reputable tax professional such as those that work for Denver Tax Services, Inc.

Jackson Hewitt

Jackson Hewitt is another major competitor that has prepared and filed millions of tax returns during their 40 year tenure. Like H&R Block, they offer both online and in person tax services to create the most convenient experience possible for their clients. They are well regarded for their refund guarantee as well as their professionalism and customer service. As such, they will be another major competitor for Denver Tax Services, Inc.

Download the Tax Preparation business plan template (including a customizable financial model) to your computer here <–

Competitive Advantage

Denver Tax Services, Inc. will be able to offer the following advantages over the competition:

- Client-oriented service: Denver Tax Services, Inc. will put a focus on customer service and maintaining long-term relationships. We aim to be the best tax preparation firm in the area by catering to our customer’s needs and developing a strong connection with them.

- Management: Robert has been extremely successful working in the tax preparation sector and will be able to use his previous experience to help his clients better than the competition.

- Competitive pricing: Denver Tax Services Inc.’s pricing is more affordable than our competitors.

- Relationships: Having lived in the community for 20 years, Robert Schwartz knows many of the local leaders, newspapers and other influencers. As such, it will be relatively easy to build a large clientbase over the next several years.

Marketing Plan

Brand & Value Proposition

Denver Tax Services, Inc. will offer a unique value proposition to its clientele:

- Client-focused tax prep services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for Denver Tax Services, Inc. is as follows:

Targeted Cold Calls

Denver Tax Services, Inc. will initially invest significant time and energy into contacting potential clients via telephone. In order to improve the effectiveness of this phase of the marketing strategy, a highly-focused call list will be used, targeting individuals in areas and occupations that are most likely to need tax prep services. As this is a very time-consuming process, it will primarily be used during the startup phase to build an initial client base.

Referrals

Denver Tax Services, Inc. understands that the best promotion comes from satisfied customers. The company will encourage its clients to refer other businesses and individuals by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

Denver Tax Services, Inc. will invest heavily in a social media advertising campaign. The company will create social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Website/SEO

Denver Tax Services, Inc. will invest heavily in developing a professional website that displays all of the company’s services. It will also invest heavily in SEO so that the firm’s website will appear at the top of search engine results.

Pricing

Denver Tax Services, Inc.’s fees will be moderate and competitive so clients feel they are receiving great value when utilizing our tax prep services.

Operations Plan

The following will be the operations plan for Denver Tax Services, Inc.

Operation Functions:

- Robert Schwartz will be the Owner of Denver Tax Services, Inc.. In addition to providing tax prep services, he will also manage the general operations of the business.

- Robert Schwartz is joined by a full-time administrative assistant, Rebecca Hackett, who will take charge of the administrative tasks for the company. She will also be available to answer client questions and will be the primary employee in charge of client communications.

- As the company builds its client base, Robert will hire more tax professionals to provide the company’s services, attract more clients, and grow our business further.

Download the Tax Preparation business plan template (including a customizable financial model) to your computer here <–

Milestones:

Denver Tax Services, Inc. will have the following milestones completed in the next six months.

- 9/2023 Finalize lease agreement

- 10/2023 Design and build out Denver Tax Services, Inc.

- 11/2023 Hire and train initial staff

- 12/2023 Kickoff of promotional campaign

- 1/2024 Launch Denver Tax Services, Inc.

- 2/2024 Reach break-even

Management Team

Denver Tax Services, Inc.’s most valuable asset is the expertise and experience of its founder, Robert Schwartz. Robert has been a certified tax professional for the past 20 years and gained his experience and clientbase by working for competing firms. After years of working with large firms (such as H&R Block), Robert decided he wanted to run his own tax prep firm where he can provide quality services in a small firm environment. He surveyed his clientbase and found that many clients would be willing to transition to his business once established. Robert’s combination of skills, tax knowledge, and loyal clientbase will ensure that Denver Tax Services, Inc. is a successful firm.

Though he has never run his own business, Robert Schwartz has worked as a tax professional long enough to gain an in-depth knowledge of the operations (e.g., running day-to-day operations) and the business (e.g., staffing, marketing, etc.) sides of the industry. He also already has a starting client base that he served while working for other tax prep firms. He will hire several other employees who can help him run the aspects of the business that he is unfamiliar with.

Financial Plan

Key Revenue & Costs

Denver Tax Services, Inc.’s revenues will primarily come from charging clients for the tax preparation services we provide. We will charge our clients an hourly rate that will vary depending on the type of tax return they are filing. Clients who owe money on their tax return will be charged directly for our services. Clients who are expecting a refund have the option to either pay us directly or let us take the fee from their refund.

The notable cost drivers for the company will include labor expenses, overhead, and marketing expenses.

Funding Requirements and Use of Funds

Denver Tax Services, Inc. is currently seeking $400,000 to launch. The funding will be dedicated to the office build out, purchase of initial equipment, working capital, marketing costs, and startup overhead expenses. The breakout of the funding is below:

- Office design/build: $100,000

- Office equipment, supplies, and materials: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $50,000

Download the Tax Preparation business plan template (including a customizable financial model) to your computer here <–

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of clients per year:

- Year 1: 30

- Year 2: 50

- Year 3: 80

- Year 4: 100

- Year 5: 140

- Annual Rent: $100,000

Financial Projections

Income Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Tax Preparation Business Plan FAQs

What Is a Tax Preparation Business Plan?

A tax preparation business plan is a plan to start and/or grow your tax preparation business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

What are the Main Types of Tax Preparation Businesses?

There are a number of different kinds of tax preparation businesses, some examples include: Certified Public Accountant (CPA), Tax Attorney, and Enrolled Agent (EA).

How Do You Get Funding for Your Tax Preparation Business Plan?

Tax Preparation businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Tax Preparation Business?

Starting a tax preparation business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Tax Preparation Business Plan - The first step in starting a business is to create a detailed tax preparation business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your tax preparation business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your tax preparation business is in compliance with local laws.

3. Register Your Tax Preparation Business - Once you have chosen a legal structure, the next step is to register your tax preparation business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your tax preparation business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Tax Preparation Equipment & Supplies - In order to start your tax preparation business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your tax preparation business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.