House Flipping Business Plan

You’ve come to the right place to create your House Flipping business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their House Flipping companies.

Below is a template to help you create each section of your House Flipping business plan.

Executive Summary

Business Overview

SW Redevelopment is a new house flipping company that specializes in buying properties in Phoenix, Arizona and turning them into exquisite homes suitable for a better living experience. The company will operate in a professional setting, conveniently located near the center of the city. Our company partners with the best contractors and designers in the city to help renovate and design the best homes possible for Phoenix residents.

SW Redevelopment is run by Erin Briggs, an MBA graduate from Arizona State University with more than 20 years of experience working as a real estate broker. Throughout her career, she realized the hardest part of selling a house is getting it in perfect condition to put on the market. That’s why she decided to start a company that takes that pressure off residents so they can sell their homes with ease.

Product Offering

SW Redevelopment will be able to provide the following services:

- Personalize house designs (both interior and exterior)

- Property restoration or renovation

- Project cost evaluation

- Broker opinion of valuation

- Marketing property for lease/sale

SW Redevelopment will primarily offer single-family residential properties.

Customer Focus

SW Redevelopment will primarily serve house buyers and sellers interested in properties within the Phoenix, Arizona area. We expect much of our customer demographic will include middle to upper-class families and first-time homebuyers.

Management Team

SW Redevelopment’s most valuable asset is the expertise and experience of its founder, Erin Briggs. Erin has been a licensed real estate broker for over the past 20 years. She has spent much of her career working in different real estate agencies and has an in-depth knowledge of the Phoenix housing market. She knows that residents struggle to renovate their homes before selling and therefore created this company to take that process off their hands.

SW Redevelopment will employ an experienced assistant to help with various administrative duties around the office. The company will also hire or partner with the best contractors and designers to design the best-looking homes in the Phoenix area.

Success Factors

SW Redevelopment will be able to achieve success by offering the following competitive advantages:

- Design Team: The design teams are made up of creative individuals that are adept at renovation, restoration, building projects. They all highly value the opinions and preferences of their clients, making their designs personal and unique to each one.

- Management: Our management team has years of business and marketing experience that allows us to market and serve clients in a much more sophisticated manner than our competitors.

- Relationships: Having lived in the community for years, Erin Briggs knows all of the local leaders, newspapers, and other influencers. As such, it will be relatively easy for us to build branding and awareness of our company.

- Location: We are located in the heart of the city and are near prime locations where we’re exposed to individuals who have the ability to purchase properties.

Download the House Flipping business plan template (including a customizable financial model) to your computer here <–

Financial Highlights

SW Redevelopment is seeking a total funding of $1,070,000 of debt capital. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses, and working capital.

Specifically, these funds will be used as follows:

- Office space build-out: $50,000

- Office equipment, supplies, and materials: $20,000

- Initial property purchase and renovations: $600,000

- Six months of overhead expenses (payroll, rent, utilities): $250,000

- Marketing costs: $50,000

- Working capital: $100,000

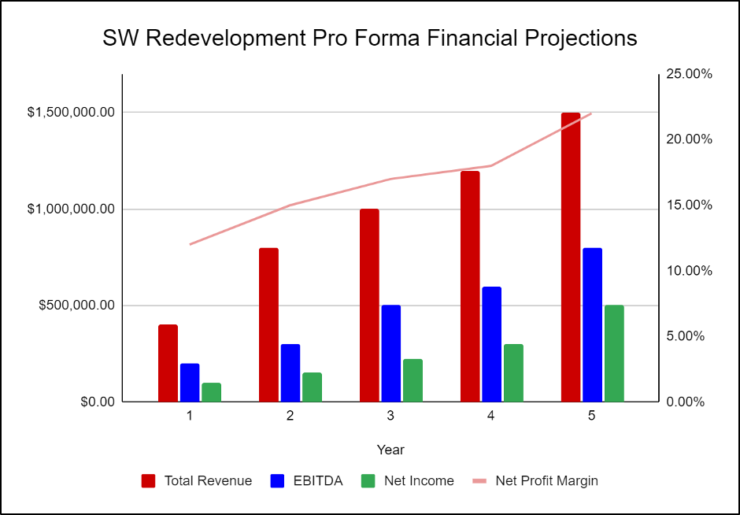

The following graph below outlines the pro forma financial projections for SW Redevelopment.

Company Overview

Who is SW Redevelopment?

SW Redevelopment is a new house flipping company that specializes in buying properties in Phoenix, Arizona and turning them into exquisite homes suitable for a better living experience. The company will operate in a professional setting, conveniently located near the center of the city. Our company partners with the best contractors and designers in the city to help renovate and design the best homes possible for Phoenix residents.

SW Redevelopment is run by Erin Briggs, an MBA graduate from Arizona State University with more than 20 years of experience working as a real estate broker. Throughout her career, she realized the hardest part of selling a house is getting it in perfect condition to put on the market. That’s why she decided to start a company that takes that pressure off residents so they can sell their homes with ease.

SW Redevelopment History

After 20 years of working in the real estate industry, Erin Briggs began researching what it would take to create a house-flipping company. This included a thorough analysis of the costs, market, demographics, and competition. Erin has compiled enough information to develop her business plan and approach investors.

Once her market analysis was complete, Erin Briggs began surveying the local office spaces available and located an ideal location for the business. Erin Briggs incorporated SW Redevelopment as a Limited Liability Corporation on October 1st, 2022.

Once the lease is finalized on the office space, renovations can be completed to make the office a welcoming environment to meet with clients.

Since incorporation, the company has achieved the following milestones:

- Acquired the perfect location for their headquarters

- Identified properties to start flipping

- Began recruiting key employees

- Utilized connections to find the best designers and contractors

SW Redevelopment Services

SW Redevelopment will be able to provide the following services:

- Personalize house designs (both interior and exterior)

- Property restoration or renovation

- Project cost evaluation

- Broker opinion of valuation

- Marketing property for lease/sale

SW Redevelopment will primarily offer single-family residential properties.

Industry Analysis

With the demand for houses increasing substantially over the past few years, there has also been a great demand for house-flipping services. House flipping helps sellers sell their homes with less work and helps buyers find the perfect home of their dreams.

The past few years have seen the largest increase in house flipping since 2006. Over 320,000 single-family homes and condos in the United States were flipped in 2021, up 26% from the previous year. This trend continued into 2022 and is expected to continue in 2023.

The factors contributing to this solid growth include rising home prices, increased sales, and greater construction combined with higher homebuyer demand. Furthermore, consumer spending will drive business expansion, and ensuing investor confidence in real estate will help raise commercial transaction volumes. Now is a great time to start a house-flipping business, as the market is sure to remain strong.

Download the House Flipping business plan template (including a customizable financial model) to your computer here <–

Customer Analysis

Demographic Profile of Target Market

SW Redevelopment will primarily serve house buyers and sellers interested in properties within the Phoenix, Arizona area. We expect much of our customer demographic will include middle to upper-class families and first-time homebuyers.

The precise demographics for Phoenix, Arizona are:

Customer Segmentation

We will primarily target the following customer segments:

- Home sellers

- Home-buyers

- Middle and upper-class families

Competitive Analysis

Direct and Indirect Competitors

SW Redevelopment will face competition from other companies with similar business profiles. A description of each competitor company is below.

Property Fortune Flippers

Founded in 1985, Property Fortune Flippers is an integrated network of companies concentrated on real estate opportunities. A leading acquirer of distressed residential real estate across the United States, Property Fortune Flippers has grown into a diversified, vertically integrated company, expanding its business footprint to include residential rehabilitation, non-performing loans, property management, private lending, brokerage, and escrow.

House Flippers

Established in 2004, House Flippers is a real estate investment, education, and coaching company. The company actively invests in real estate and has been involved in more than $1 billion of residential and commercial real estate investments since its inception. This success prompted the company to develop a systemized process that could be taught to prospective investors. The company manages between 25 and 40 ongoing redevelopment single-family and multi-family projects at all times, as well as acquiring apartment communities, retail shopping centers, and office buildings.

Equity Investors

Established in 2007, Equity Investors is a real estate investment firm. It seeks to invest in distressed residential and commercial real estate asset investment, management, multifamily, workouts, and turnaround strategies in the United States and internationally. It focuses on raising, investing, and managing third-party capital, originating and securitizing commercial mortgage loans. Since its inception, Equity Investors has participated in the investment of billions of dollars of equity in real estate assets.

Download the House Flipping business plan template (including a customizable financial model) to your computer here <–

Competitive Advantage

SW Redevelopment enjoys several advantages over its competitors. These advantages include:

- Design Team: The design teams are made up of creative individuals that are adept at renovation, restoration, building projects. They all highly value the opinions and preferences of their clients, making their designs personal and unique to each one.

- Management: Our management team has years of business and marketing experience that allows us to market and serve clients in a much more sophisticated manner than our competitors.

- Relationships: Having lived in the community for years, Erin Briggs knows all of the local leaders, newspapers, and other influencers. As such, it will be relatively easy for us to build branding and awareness of our company.

- Location: We are located in the heart of the city and are near prime locations where we’re exposed to individuals who have the ability to purchase properties.

Marketing Plan

Brand & Value Proposition

The SW Redevelopment brand will focus on the Company’s unique value proposition:

- Client-focused designs, where the company’s design and floor plans are aligned with the customer’s specific needs

- Service built on long-term relationships and personal attention

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for SW Redevelopment is as follows:

Direct Mail

The company will market its newly renovated homes with beautiful marketing pieces that are sent to local residents and real estate agents.

Open House Events

The company will host creative and appealing open house events to attract top real estate brokers and potential home buyers. Events will be entertaining and include food and drink.

Website/SEO

SW Redevelopment will invest heavily in developing a professional website that displays all of the features and benefits of the company. It will also invest heavily in SEO so the brand’s website will appear at the top of search engine results.

Social Media

SW Redevelopment will invest heavily in a social media advertising campaign. The marketing manager will create the company’s social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Pricing

SW Redevelopment will resell its renovated homes at a competitive market price.

Operations Plan

The following will be the operations plan for SW Redevelopment.

Operation Functions:

- Erin Briggs will be the President of the company. She will oversee all staff and manage client relations. She will also oversee all major aspects of the development and renovation projects.

- Erin is assisted by Eva Reed. Eva will serve as the administrative assistant, helping out with all paperwork, phone calls, and other general administrative tasks for the company.

- As the company grows and invests in new properties, Erin will hire several project managers to assist her.

- Erin is also in the process of hiring teams of architects, designers, contractors, and other professionals needed to successfully flip and renovate each property.

Download the House Flipping business plan template (including a customizable financial model) to your computer here <–

Milestones:

The following are a series of steps that lead to our vision of long-term success. SW Redevelopment expects to achieve the following milestones in the following six months:

3/202X Finalize lease agreement

4/202X Design and build out SW Redevelopment

5/202X Hire and train initial staff

6/202X Kickoff of promotional campaign

7/202X Launch SW Redevelopment

8/202X Reach break-even

Management Team

SW Redevelopment’s most valuable asset is the expertise and experience of its founder, Erin Briggs. Erin has been a licensed real estate broker for over the past 20 years. She has spent much of her career working in different real estate agencies and has an in-depth knowledge of the Phoenix housing market. She knows that residents struggle to renovate their homes before selling and therefore created this company to take that process off their hands.

SW Redevelopment will employ an experienced assistant to help with various administrative duties around the office. The company will also hire or partner with the best contractors and designers to design the best-looking homes in the Phoenix area.

Financial Plan

Key Revenue & Costs

SW Redevelopment’s revenues will come primarily from the earnings from property sales and revamping projects. More than half of the deals each quarter are expected to be design projects, and the rest will be from sales.

As with most services, labor expenses will be key cost drivers. Erin Briggs and future employees will earn a competitive base salary. Furthermore, the costs of transactions are projected to be roughly 45% of regular revenue and cover the advertising of listings, travel and supply costs for clients, and other direct costs for each deal.

Ongoing marketing expenditures are also notable cost drivers for SW Redevelopment, especially in the first few years as the company works to establish itself in the market.

Funding Requirements and Use of Funds

SW Redevelopment is seeking a total funding of $1,070,000 of debt capital. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses, and working capital.

Specifically, these funds will be used as follows:

- Office space build-out: $50,000

- Office equipment, supplies, and materials: $20,000

- Initial property purchase and renovations: $600,000

- Six months of overhead expenses (payroll, rent, utilities): $250,000

- Marketing costs: $50,000

- Working capital: $100,000

Download the House Flipping business plan template (including a customizable financial model) to your computer here <–

Key Assumptions

The following table reflects the key revenue and cost assumptions made in the financial model:

- Houses flipped per year

- FY 1: 5

- FY 2: 10

- FY 3: 15

- FY 4: 20

- FY 5: 25

Financial Projections

Income Statement

FY 1 FY 2 FY 3 FY 4 FY 5 Revenues Total Revenues $360,000 $793,728 $875,006 $964,606 $1,063,382 Expenses & Costs Cost of goods sold $64,800 $142,871 $157,501 $173,629 $191,409 Lease $50,000 $51,250 $52,531 $53,845 $55,191 Marketing $10,000 $8,000 $8,000 $8,000 $8,000 Salaries $157,015 $214,030 $235,968 $247,766 $260,155 Initial expenditure $10,000 $0 $0 $0 $0 Total Expenses & Costs $291,815 $416,151 $454,000 $483,240 $514,754 EBITDA $68,185 $377,577 $421,005 $481,366 $548,628 Depreciation $27,160 $27,160 $27,160 $27,160 $27,160 EBIT $41,025 $350,417 $393,845 $454,206 $521,468 Interest $23,462 $20,529 $17,596 $14,664 $11,731 PRETAX INCOME $17,563 $329,888 $376,249 $439,543 $509,737 Net Operating Loss $0 $0 $0 $0 $0 Use of Net Operating Loss $0 $0 $0 $0 $0 Taxable Income $17,563 $329,888 $376,249 $439,543 $509,737 Income Tax Expense $6,147 $115,461 $131,687 $153,840 $178,408 NET INCOME $11,416 $214,427 $244,562 $285,703 $331,329 Balance Sheet

FY 1 FY 2 FY 3 FY 4 FY 5 ASSETS Cash $154,257 $348,760 $573,195 $838,550 $1,149,286 Accounts receivable $0 $0 $0 $0 $0 Inventory $30,000 $33,072 $36,459 $40,192 $44,308 Total Current Assets $184,257 $381,832 $609,654 $878,742 $1,193,594 Fixed assets $180,950 $180,950 $180,950 $180,950 $180,950 Depreciation $27,160 $54,320 $81,480 $108,640 $135,800 Net fixed assets $153,790 $126,630 $99,470 $72,310 $45,150 TOTAL ASSETS $338,047 $508,462 $709,124 $951,052 $1,238,744 LIABILITIES & EQUITY Debt $315,831 $270,713 $225,594 $180,475 $135,356 Accounts payable $10,800 $11,906 $13,125 $14,469 $15,951 Total Liability $326,631 $282,618 $238,719 $194,944 $151,307 Share Capital $0 $0 $0 $0 $0 Retained earnings $11,416 $225,843 $470,405 $756,108 $1,087,437 Total Equity $11,416 $225,843 $470,405 $756,108 $1,087,437 TOTAL LIABILITIES & EQUITY $338,047 $508,462 $709,124 $951,052 $1,238,744 Cash Flow Statement

FY 1 FY 2 FY 3 FY 4 FY 5 CASH FLOW FROM OPERATIONS Net Income (Loss) $11,416 $214,427 $244,562 $285,703 $331,329 Change in working capital ($19,200) ($1,966) ($2,167) ($2,389) ($2,634) Depreciation $27,160 $27,160 $27,160 $27,160 $27,160 Net Cash Flow from Operations $19,376 $239,621 $269,554 $310,473 $355,855 CASH FLOW FROM INVESTMENTS Investment ($180,950) $0 $0 $0 $0 Net Cash Flow from Investments ($180,950) $0 $0 $0 $0 CASH FLOW FROM FINANCING Cash from equity $0 $0 $0 $0 $0 Cash from debt $315,831 ($45,119) ($45,119) ($45,119) ($45,119) Net Cash Flow from Financing $315,831 ($45,119) ($45,119) ($45,119) ($45,119) Net Cash Flow $154,257 $194,502 $224,436 $265,355 $310,736 Cash at Beginning of Period $0 $154,257 $348,760 $573,195 $838,550 Cash at End of Period $154,257 $348,760 $573,195 $838,550 $1,149,286 House Flipping Business Plan FAQs

What Is a House Flipping Business Plan?

A house flipping business plan is a plan to start and/or grow your house flipping business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

What are the Main Types of House Flipping Businesses?

There are a number of different kinds of house flipping businesses, some examples include: Single Family Home, Multi-unit Complex, and Multi-investor Flipping.

How Do You Get Funding for Your House Flipping Business Plan?

House Flipping businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a House Flipping Business?

Starting a house flipping business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A House Flipping Business Plan - The first step in starting a business is to create a detailed house flipping business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your house flipping business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your house flipping business is in compliance with local laws.

3. Register Your House Flipping Business - Once you have chosen a legal structure, the next step is to register your house flipping business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your house flipping business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary House Flipping Equipment & Supplies - In order to start your house flipping business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your house flipping business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful house flipping business:

Other Helpful Templates

Cleaning Business Plan Template

Mortgage Broker Business Plan Template