Holding Company Business Plan

You’ve come to the right place to create your Holding Company business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Holding Companies.

Below is a template to help you create each section of your Holding Company business plan.

Executive Summary

Business Overview

Caldwell Corporation, located in Los Angeles, California, is a newly established holding company that was formed to be the controlling stockholder in other companies it has invested in. It will initially control the Caldwell Group (Caldwell Products, Caldwell Entertainment, and Caldwell Technology) but will invest in other companies in the future. Caldwell Corporation will own assets in both public and private companies, ranging from real estate and manufacturing to entertainment and technology. The company solely performs oversight and is not involved in managing or day-to-day operations.

Caldwell Corporation is run by Timothy Caldwell. He has founded and run all the companies in the Caldwell Group with tremendous success. He is starting the Caldwell Corporation to create a more central point of control over his businesses and make it easier to invest in companies that will support the overall Caldwell Corporation mission.

Services

Caldwell Corporation will provide a number of benefits and services to its subsidiaries. Those benefits include risk mitigation, asset protection, tax minimization, central control, flexibility for growth and development, and succession planning.

The primary benefit for Caldwell Corporation is to minimize the risk for its subsidiaries that forming and operating a company entails. If the subsidiary were to be sued, the liability would not exist, as the holding company would assume the risk as it is a controlling shareholder. Risk management is enhanced by dividing its assets across multiple companies.

Customer Focus

The initial focus will be to control the companies in the Caldwell Group. After that, Caldwell Corporation will primarily serve small to midsize companies across the United States. The demographics of these companies are as follows:

- Must have profits of at least $3 million per year

- Must be in business for at least two years

- Must have a board of directors in place

- Must be in a growing industry

- Has not been audited by the IRS or SEC

Caldwell Corporation will target new and growing businesses that show a growing profit margin for its shareholders.

Management Team

Caldwell Corporation is led by Timothy Caldwell. Over the past ten years, Timothy has started and successfully led the Caldwell Group of companies: Caldwell Products, Caldwell Entertainment, and Caldwell Technology. Now, he wishes to create a holding company to develop a more central point of control over his businesses as well as any companies that he will invest in in the future. Since he has run these three companies himself for the past ten years, he has an in-depth knowledge of their operations and financials.

Timothy is assisted by his executive team that runs the Caldwell Group of companies: Taylor Fisher (CFO), Andy Carrell (COO), Shelby Smith (CMO), and Dave Reddings (CTO).

Success Factors

Caldwell Corporation will be able to achieve success by offering the following competitive advantages:

- Senior Leadership: Timothy Caldwell is an active player in the stock market and is adept at studying companies and assessing their financial volatility.

- Oversight: While Caldwell Corporation will not act as an official oversight of leadership of the companies it acquires, the company will be available and able to provide knowledge and expertise when requested.

- Tax Minimization: Caldwell Corporation is skilled at providing tax scenarios for its companies that are more beneficial to the shareholders. It involves moving corporate locations to tax-friendly states, finding loopholes, and maximizing available tax credits.

- Asset Protection: Caldwell Corporation will employ the best legal, tax, and accounting teams to ensure that all entities involved are not burdened with heavy tax fines, lawsuits, or bankruptcies.

Download the Holding Company business plan template (including a customizable financial model) to your computer here <–

Financial Highlights

Caldwell Corporation is seeking a total funding of $300,000 of debt capital to launch. The capital will be used for funding office buildout, legal fees, overhead expenses, and working capital.

- Office design/build-out: $50,000

- Legal fees and retainer: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Working capital: $50,000

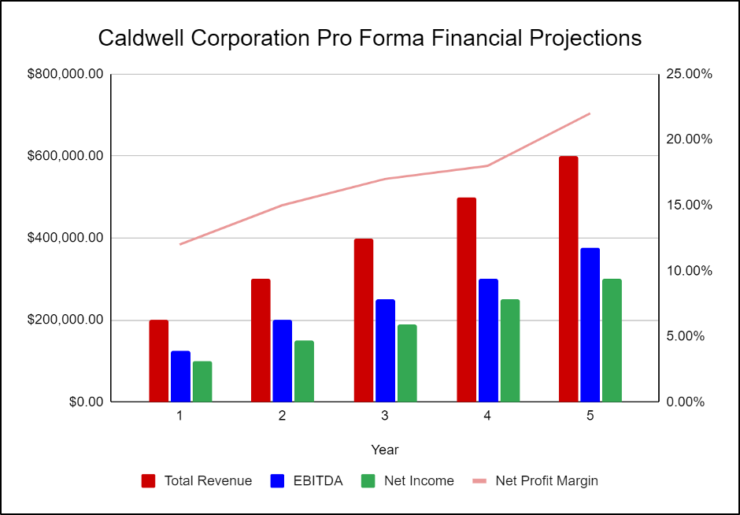

The following graph below outlines the pro forma financial projections for Caldwell Corporation.

Company Overview

Who is Caldwell Corporation?

Caldwell Corporation, located in Los Angeles, California, is a newly established holding company that was formed to be the controlling stockholder in other companies it has invested in. It will initially control the Caldwell Group (Caldwell Products, Caldwell Entertainment, and Caldwell Technology) but will invest in other companies in the future. Caldwell Corporation will own assets in both public and private companies, ranging from real estate and manufacturing to entertainment and technology. The company solely performs oversight and is not involved in managing or day-to-day operations.

Caldwell Corporation is run by Timothy Caldwell. He has founded and run all the companies in the Caldwell Group with tremendous success. He is starting the Caldwell Corporation to create a more central point of control over his businesses and make it easier to invest in companies that will support the overall Caldwell Corporation mission.

Caldwell Corporation History

Timothy Caldwell incorporated Caldwell Corporation as an S-Corporation on 1/10/2023. Soon after, he found an office location that will serve as the headquarters of the company.

Since its incorporation, Caldwell Corporation has achieved the following milestones:

- Found an office location and signed a Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Engaged a legal and accounting team

Caldwell Corporation Services

Caldwell Corporation will provide a number of benefits and services to its subsidiaries. Those benefits include risk mitigation, asset protection, tax minimization, central control, flexibility for growth and development, and succession planning.

The primary benefit for Caldwell Corporation is to minimize the risk for its subsidiaries that forming and operating a company entails. If the subsidiary were to be sued, the liability would not exist, as the holding company would assume the risk as it is a controlling shareholder. Risk management is enhanced by dividing its assets across multiple companies.

Industry Analysis

Holding companies have fared well for decades and are expected to continue to perform well for the foreseeable future. Success will be driven by strong company leadership, robust and efficient operational models, and talent management.

Holding companies offer numerous benefits to their subsidiaries. These include risk mitigation, asset protection, tax minimization, central control, flexibility for growth and development, and succession planning. With so many benefits, numerous companies join or create holding companies every year.

Some of the most high-profile companies benefit from a holding company. Some examples include Google, which is controlled by Alphabet, and the high-profile companies (like Dairy Queen and Duracell) that are controlled by Berkshire Hathaway. With so many profitable companies benefiting from the arrangement, holding companies are bound to continue to succeed in the future.

Download the Holding Company business plan template (including a customizable financial model) to your computer here <–

Customer Analysis

Demographic Profile of Target Market

Caldwell Corporation will primarily serve small to midsize companies across the United States. There are numerous startup businesses or organizations that have been in business for at least two years that have already achieved profits exceeding at least $2 million. These companies are in industries such as entertainment, technology, and real estate.

Customer Segmentation

Caldwell Corporation will primarily target the following three customer segments:

- Technology companies

- Entertainment companies

- Real estate ventures

Competitive Analysis

Direct and Indirect Competitors

The following businesses have the same business profile as Caldwell Corporation, thus providing either direct or indirect competition for customer clients:

Lithium Holdings

Lithium Holdings buys and grows mid-sized technology companies. Upon acquiring technology companies, Lithium Holdings delivers high-quality equipment along with janitorial and technology supplies. As a veteran-owned company, they are able to tap into the veteran and military-owned community. Lithium offers a much-needed layer of oversight for mid-sized technology companies that do not have the operational expertise or bank account for operational expenses. Lithium Holdings has the financial backing and creditworthiness to apply for small business loans for the technology companies it acquires. The company is able to provide a strategic growth plan for a technology company that it otherwise does not have. At this time, the company focuses on companies in the southwestern United States but may grow to other regions as their geographic footprint allows.

Deer Holdings

In business for over 50 years, Deer Holdings has acquired, invested in, grown, and sold companies across various industries. Today, Deer Holdings invests in businesses that operate within the real estate, infrastructure, and financial services space. Deer’s real estate companies are specifically focused on infrastructure assets, single-family rentals, federal and state low-income housing, tax credits, large living communities, mixed-use communities, development, and military communities.

Deer’s financial services companies focus on providing debt capital to owners of multifamily, senior housing, office, retail, technology, and self-storage properties through proprietary loan products as well as products offered through Fannie Mae, Freddie Mac, and FHA. They also focus on companies that deliver high-quality investment ideas and investment banking services to institutional investors and corporate clients. In addition to real estate and banking, Deer has invested in a multitude of companies that are within the energy and utility industries. One of their most successful companies is an electrical contractor and owner of utility systems that specializes in the provision of services to the military under privatization contracts.

Greenfield Companies

Greenfield Companies is a multinational conglomerate that operates in the United States. Headquartered in Los Angeles, Greenfield prefers to invest in companies in long-term investments in publicly traded companies and has recently begun to invest in wholly-owned subsidiaries. Their diverse range of businesses includes confectionery, retail, railroads, home furnishings, home products, jewelry, retail clothing, and several regional electric and gas utilities.

Greenfield was established over a hundred years ago when it got its start investing in textile manufacturers and railroads. The company was one of the few large shareholder companies that were able to survive the Great Depression, despite it being a freshman company at the time. Throughout the decades, Greenfield has maintained being a family-led company, with the great great great grandson of Benjamin Greenfield now at the company’s helm.

Greenfield Companies is a major player in the stock market and is often studied as a model of how to ride market volatility during recessions and instability in the national economy.

Download the Holding Company business plan template (including a customizable financial model) to your computer here <–

Competitive Advantage

Caldwell Corporation enjoys several advantages over its competitors. Those advantages include the following:

- Senior Leadership: Timothy Caldwell is an active player in the stock market and is adept at studying companies and assessing their financial volatility.

- Oversight: While Caldwell Corporation will not act as an official oversight of leadership of the companies it acquires, the company will be available and able to provide knowledge and expertise when requested.

- Tax Minimization: Caldwell Corporation is skilled at providing tax scenarios for its companies that are more beneficial to the shareholders. It involves moving corporate locations to tax-friendly states, finding loopholes, and maximizing available tax credits.

- Asset Protection: Caldwell Corporation will employ the best legal, tax, and accounting teams to ensure that all entities involved are not burdened with heavy tax fines, lawsuits, or bankruptcies.

Marketing Plan

Caldwell Corporation seeks to position itself as a premier holding company in the Los Angeles area. Subsidiaries can expect to place their interests in the companies’ hands so they can focus on providing the specific products and services that it intends to specialize in.

Brand & Value Proposition

The Caldwell Corporation brand will focus on the company’s unique value proposition:

- Proven leadership

- Complete asset protection

- Beneficial tax scenarios

- Oversight and accountability

- Knowledgeable team of experts

Promotions Strategy

Caldwell Corporation expects its target market to be companies operating in certain industries. The company’s promotion strategy to reach these companies includes:

Industry Publications

Caldwell Corporation will invest in strategically placing ads in industry publications such as newsletters, magazines, and journals. The target audience for these publications usually includes the decision-makers in their companies.

Social Media

Caldwell Corporation will invest heavily in a social media advertising campaign. The brand manager will create the company’s social media accounts and invest in ads on social media. It will use targeted marketing to appeal to the target demographics. It will focus mainly on LinkedIn social media accounts rather than other social media channels like Facebook and Instagram.

Website/SEO

Caldwell Corporation will invest heavily in developing a professional website that displays all of the benefits the holding company has to offer. It will also invest heavily in SEO so that the brand’s website will appear at the top of search engine results.

Industry Conferences

Caldwell Corporation will participate in all of the industry conferences and tradeshows to network with decision-makers of certain companies. This will be done to increase brand awareness and recognition.

Operations Plan

The following will be the operations plan for Caldwell Corporation.

Operation Functions:

- Timothy Caldwell will be the CEO of Caldwell Corporation. He will continue to run his other companies while handling the general operations of Caldwell Corporation.

- Taylor Fisher has been Tim’s CFO for several years and will take on this role for Caldwell Corporation. He will handle all the concerns related to finances, investments, and taxes.

- Andy Carrell is the COO of Tim’s other companies and will assist Caldwell Corporation with the operations and administrative aspects of the business.

- Shelby Smith has been Tim’s CMO for several years and will expand her role to help with the marketing efforts for Caldwell Corporation.

- Dave Reddings has been Tim’s CTO for several years and will handle all the major decisions and actions relating to technology.

Download the Holding Company business plan template (including a customizable financial model) to your computer here <–

Milestones:

The following are a series of steps that lead to our vision of long-term success. Caldwell Corporation expects to achieve the following milestones in the following six months:

4/202X Finalize lease agreement

5/202X Design and build out Caldwell Corporation

6/202X Hire and train initial staff

7.202X Kickoff of promotional campaign

8/202X Launch Caldwell Corporation

9/202X Reach break-even

Management Team

Caldwell Corporation is led by Timothy Caldwell. Over the past ten years, Timothy has started and successfully led the Caldwell Group of companies: Caldwell Products, Caldwell Entertainment, and Caldwell Technology. Now, he wishes to create a holding company to develop a more central point of control over his businesses as well as any companies that he will invest in in the future. Since he has run these three companies himself for the past ten years, he has an in-depth knowledge of their operations and financials.

Timothy is assisted by his executive team that runs the Caldwell Group of companies: Taylor Fisher (CFO), Andy Carrell (COO), Shelby Smith (CMO), and Dave Reddings (CTO).

Financial Plan

Key Revenue & Costs

Caldwell Corporation’s revenues will come primarily from its stockholder distributions. The company will acquire various subsidiaries. It will position itself to be the majority stockholder and will receive quarterly and annual distributions.

The office lease, office equipment, supplies, and labor expenses will be the key cost drivers of Caldwell Corporation. The major cost drivers for the company’s operation will consist of salaries, equipment, lease, taxes, and overhead expenses. Ongoing marketing expenditures are also notable cost drivers for Caldwell Corporation.

Funding Requirements and Use of Funds

Caldwell Corporation is seeking a total funding of $300,000 of debt capital to open the holding company. The capital will be used for funding office buildout, legal fees, overhead expenses, and working capital.

- Office design/build-out: $50,000

- Legal fees and retainer: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Working capital: $50,000

Download the Holding Company business plan template (including a customizable financial model) to your computer here <–

Key Assumptions

Below are the key assumptions required in order to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Annual office lease: $20,000

- Number of subsidiaries:

- FY1: 3

- FY2: 4

- FY3: 5

- FY4: 6

- FY5: 7

Financial Projections

Income Statement

FY 1 FY 2 FY 3 FY 4 FY 5 Revenues Total Revenues $360,000 $793,728 $875,006 $964,606 $1,063,382 Expenses & Costs Cost of goods sold $64,800 $142,871 $157,501 $173,629 $191,409 Lease $50,000 $51,250 $52,531 $53,845 $55,191 Marketing $10,000 $8,000 $8,000 $8,000 $8,000 Salaries $157,015 $214,030 $235,968 $247,766 $260,155 Initial expenditure $10,000 $0 $0 $0 $0 Total Expenses & Costs $291,815 $416,151 $454,000 $483,240 $514,754 EBITDA $68,185 $377,577 $421,005 $481,366 $548,628 Depreciation $27,160 $27,160 $27,160 $27,160 $27,160 EBIT $41,025 $350,417 $393,845 $454,206 $521,468 Interest $23,462 $20,529 $17,596 $14,664 $11,731 PRETAX INCOME $17,563 $329,888 $376,249 $439,543 $509,737 Net Operating Loss $0 $0 $0 $0 $0 Use of Net Operating Loss $0 $0 $0 $0 $0 Taxable Income $17,563 $329,888 $376,249 $439,543 $509,737 Income Tax Expense $6,147 $115,461 $131,687 $153,840 $178,408 NET INCOME $11,416 $214,427 $244,562 $285,703 $331,329 Balance Sheet

FY 1 FY 2 FY 3 FY 4 FY 5 ASSETS Cash $154,257 $348,760 $573,195 $838,550 $1,149,286 Accounts receivable $0 $0 $0 $0 $0 Inventory $30,000 $33,072 $36,459 $40,192 $44,308 Total Current Assets $184,257 $381,832 $609,654 $878,742 $1,193,594 Fixed assets $180,950 $180,950 $180,950 $180,950 $180,950 Depreciation $27,160 $54,320 $81,480 $108,640 $135,800 Net fixed assets $153,790 $126,630 $99,470 $72,310 $45,150 TOTAL ASSETS $338,047 $508,462 $709,124 $951,052 $1,238,744 LIABILITIES & EQUITY Debt $315,831 $270,713 $225,594 $180,475 $135,356 Accounts payable $10,800 $11,906 $13,125 $14,469 $15,951 Total Liability $326,631 $282,618 $238,719 $194,944 $151,307 Share Capital $0 $0 $0 $0 $0 Retained earnings $11,416 $225,843 $470,405 $756,108 $1,087,437 Total Equity $11,416 $225,843 $470,405 $756,108 $1,087,437 TOTAL LIABILITIES & EQUITY $338,047 $508,462 $709,124 $951,052 $1,238,744 Cash Flow Statement

FY 1 FY 2 FY 3 FY 4 FY 5 CASH FLOW FROM OPERATIONS Net Income (Loss) $11,416 $214,427 $244,562 $285,703 $331,329 Change in working capital ($19,200) ($1,966) ($2,167) ($2,389) ($2,634) Depreciation $27,160 $27,160 $27,160 $27,160 $27,160 Net Cash Flow from Operations $19,376 $239,621 $269,554 $310,473 $355,855 CASH FLOW FROM INVESTMENTS Investment ($180,950) $0 $0 $0 $0 Net Cash Flow from Investments ($180,950) $0 $0 $0 $0 CASH FLOW FROM FINANCING Cash from equity $0 $0 $0 $0 $0 Cash from debt $315,831 ($45,119) ($45,119) ($45,119) ($45,119) Net Cash Flow from Financing $315,831 ($45,119) ($45,119) ($45,119) ($45,119) Net Cash Flow $154,257 $194,502 $224,436 $265,355 $310,736 Cash at Beginning of Period $0 $154,257 $348,760 $573,195 $838,550 Cash at End of Period $154,257 $348,760 $573,195 $838,550 $1,149,286 Holding Company Business Plan FAQs

What Is a Holding Company Business Plan?

A holding company business plan is a plan to start and/or grow your holding company business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

What are the Main Types of Holding Companies?

There are a number of different kinds of holding companies, some examples include: Pure Holding Company, Mixed Holding Company, Immediate Holding Company, or Intermediate Holding Company.

How Do You Get Funding for Your Holding Company Business Plan?

Holding Company businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

How Do You Get Funding for Your Holding Company Business Plan?

Holding Company businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Holding Company Business?

Starting a holding company business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Holding Company Business Plan - The first step in starting a business is to create a detailed holding company business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your holding company business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your holding company business is in compliance with local laws.

3. Register Your Holding Company Business - Once you have chosen a legal structure, the next step is to register your holding company business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your holding company business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Holding Company Equipment & Supplies - In order to start your holding company business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your holding company business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.