Bitcoin Mining Business Plan

You’ve come to the right place to create your Bitcoin Mining business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Bitcoin Mining companies.

Below is a template to help you create each section of your Bitcoin Mining business plan.

Executive Summary

Business Overview

Pacific Blockchain is a new bitcoin mining business located in Seattle, Washington. It is run by Daniel Baker who has been mining bitcoin for six years. Throughout that time, he earned $250,000 worth of bitcoin from his efforts. To continue his success, he decided to pool his resources with other successful miners and create this company. Pacific Blockchain currently has ten mining rigs and three miners in the pool. In the future, the company will be open to bringing in more miners for a membership fee.

Product Offering

Pacific Blockchain’s only goal is to mine bitcoin. All miners in the pool will work towards this goal and all profits earned will be divided equally amongst pool members. Future miners who wish to join the pool will have to pay a membership fee.

Customer Focus

As a bitcoin mining company, Pacific Blockchain does not have a traditional customer base. The company only focuses on making sure the pool is mining enough bitcoin so everyone can make a profit. The pool currently has three miners but is open to bringing more on board.

Management Team

Pacific Blockchain is led by Daniel Baker who has been bitcoin mining since 2017. He has made $250,000 in profit through mining bitcoin and is eager to expand his business. He recently connected with two other local bitcoin miners and they all decided to pool their resources together to ensure a higher rate of success. Daniel also holds an MBA from University of Washington which has given him the education and expertise to run a business.

Success Factors

Pacific Blockchain will be able to achieve success by offering the following competitive advantages:

- Management: The management team has extensive bitcoin mining experience which will be attractive to new bitcoin miners.

- Track record of success: Daniel Baker’s success with bitcoin has led to $250,000 in profits thus far.

- Community: Pacific Blockchain is a small bitcoin mining pool that offers community and support to new miners. This community is hard to find in larger firms that have thousands of miners.

Download the Bitcoin Mining business plan template (including a customizable financial model) to your computer here <–

Financial Highlights

Pacific Blockchain is currently seeking $450,000 to launch. Funding will be dedicated towards three months of overhead costs to include payroll of the staff, rent, and marketing costs. Specifically, these funds will be used as follows:

- Location design/build: $50,000

- Equipment purchase upkeep: $250,000

- Three months of overhead expenses (payroll, rent, utilities): $100,000

- Marketing costs: $25,000

- Working capital: $25,000

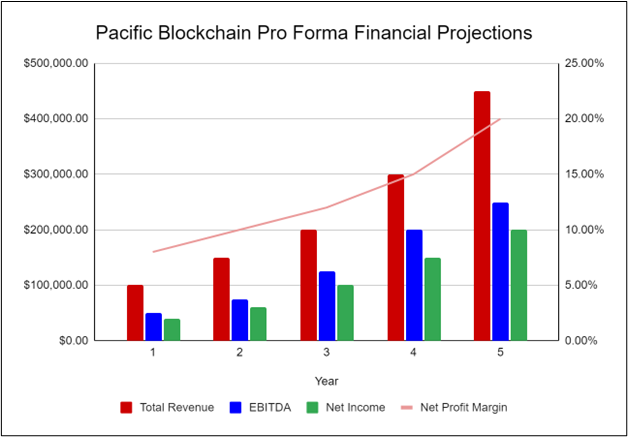

The following graph below outlines the pro forma financial projections for Pacific Blockchain.

Company Overview

Who is Pacific Blockchain?

Pacific Blockchain is a new bitcoin mining business located in Seattle, Washington. It is run by Daniel Baker who has been mining bitcoin for six years. Throughout that time, he earned $250,000 worth of bitcoin from his efforts. To continue his success, he decided to pool his resources with other successful miners and create this company. Pacific Blockchain currently has ten mining rigs and three miners in the pool. In the future, the company will be open to bringing in more miners for a membership fee.

Pacific Blockchain History

Daniel Baker incorporated Pacific Blockchain as an LLC. The business is currently being run out of Daniel’s home, but once the lease on Pacific Blockchain’s office location is finalized, all operations will be run from there.

Since incorporation, the company has achieved the following milestones:

- Found a business location and signed a Letter of Intent to lease it.

- Developed the company’s name, logo, and website.

- Determined equipment requirements

Pacific Blockchain Services

Pacific Blockchain’s only goal is to mine bitcoin. All miners in the pool will work towards this goal and all profits earned will be divided equally amongst pool members. Future miners who wish to join the pool will have to pay a membership fee.

Industry Analysis

Cryptocurrency has completely transformed the finance industry and economy in a very short amount of time. Just a decade ago, few people understood cryptocurrency and even fewer establishments accepted it as a form of payment. Now there are millions of crypto-miners around the world and cryptocurrency is a widely accepted form of currency.

However, while a few years ago a home computer was enough to mine bitcoin and other cryptocurrencies, today the market is too competitive for normal computers to generate a meaningful profit. Therefore, there is increasing demand for more powerful equipment and for bitcoin mining farms and pools to form so miners can pool their resources together.

Cryptocurrency mining is a risky but highly rewarding revenue stream. This year, solving a block will earn a miner 6.25 BTC, which is roughly valued at $177K. A miner can earn a decent revenue from bitcoin, even if they only solve one or two blocks. However, due to the aforementioned competition, it is extremely difficult for any miner to earn substantial bitcoin. Therefore, it is important to collaborate with other miners and pool multiple rigs and other resources.

Despite what the critics say, bitcoin and other cryptocurrencies are here to stay. According to research the cryptocurrency industry was valued at $4.67 billion last year and is expected to expand at a compound annual growth rate (CAGR) of 12.5% over the next five years. This is a very high growth rate and shows that mining bitcoin is still a very profitable business.

Download the Bitcoin Mining business plan template (including a customizable financial model) to your computer here <–

Customer Analysis

Demographic Profile of Target Market

Pacific Blockchain will serve the miners that join its pool to mine bitcoin. Though the company is based in Seattle, Washington, we will open our pool to miners that live anywhere throughout the United States.

Customer Segmentation

The only customer segmentation that Pacific Blockchain will focus on is fellow bitcoin miners who are interested in joining the mining pool.

Competitive Analysis

Direct and Indirect Competitors

Pacific Blockchain will face competition from other companies with similar business profiles. A description of each competitor company is below.

Riot Blockchain

Riot Blockchain is one of the top bitcoin mining companies in the world. Located in Rockdale, Texas, the company operates over 30,000 mining rigs and had a total of 4,884 BTC tokens in reserve at the end of 2021. In addition to running its own facilities, it also offers services and support to other large-scale mining businesses so they can take advantage of Riot’s proprietary infrastructure and establish their own farms.

Marathon Digital Holdings

Marathon Digital Holdings is another major competitor in the world of bitcoin. A former uranium and vanadium exploration business, this bitcoin mining company reportedly had reserves of 8,115 BTC at the end of 2021. Marathon has facilities located in South Dakota, Nebraska, Montana, and Texas and is committed to powering its facilities with renewable energy in the near future.

Cipher Mining

Cipher is the third major competitor of Pacific Blockchain. It is a fast-growing firm and has recently built its first facility in Alborz, Texas. It is expected to be a very successful firm, as it recently acquired 27,000 and 60,000 miners from Bitmain Technologies and SuperAcme Technologies respectively.

Download the Bitcoin Mining business plan template (including a customizable financial model) to your computer here <–

Competitive Advantage

Pacific Blockchain will be able to offer the following advantages over their competition:

- Management:The management team has extensive bitcoin mining experience which will be attractive to new bitcoin miners.

- Track record of success: Daniel Baker’s success with bitcoin has led to $250,000 in profits thus far.

- Community: Pacific Blockchain is a small bitcoin mining pool that offers community and support to new miners. This community is hard to find in larger firms that have thousands of miners.

Marketing Plan

Brand & Value Proposition

Pacific Blockchain will offer the unique value proposition to its clientele:

- Extensive bitcoin experience

- A track record of success

- A welcoming community of fellow miners

Promotions Strategy

The promotions strategy for Pacific Blockchain is as follows:

Website/SEO

Pacific Blockchain will invest in developing a professional website that displays all of the features offered by the company. It will also invest in SEO so that the company’s website will appear at the top of search engine results.

Social Media

Daniel will create the company’s social media accounts and invest in ads on all social media platforms. The company will use targeted marketing to appeal to the target demographic.

Word of Mouth Marketing

Pacific Blockchain will encourage word-of-mouth marketing from loyal and satisfied miners.

Pricing

All profits made through mining will be shared equally amongst the pool members. New miners who sign up with the pool will pay a 2% fee.

Operations Plan

The following will be the operations plan for Pacific Blockchain.

Operation Functions:

- Daniel Baker is the owner of Pacific Blockchain. He will run the general operations and be the primary miner of bitcoin.

- Daniel is joined by Zachary Ertle and Walter Wright. Zachary and Walter are also seasoned miners who have earned substantial profit from bitcoin. They will contribute their equipment and resources and assist Daniel with bitcoin mining.

Download the Bitcoin Mining business plan template (including a customizable financial model) to your computer here <–

Milestones:

Pacific Blockchain will have the following milestones completed in the next six months.

- 05/202X – Finalize lease agreement

- 06/202X – Finish design and build out of office

- 07/202X – Purchase rigs and other equipment

- 08/202X – Kickoff of promotional campaign

- 09/202X – Launch Pacific Blockchain

- 10/202X – Successfully mine bitcoin

Management Team

Pacific Blockchain is led by Daniel Baker who has been bitcoin mining since 2017. He has made $250,000 in profit through mining bitcoin and is eager to expand his business. He recently connected with two other local bitcoin miners and they all decided to pool their resources together to ensure a higher rate of success. Daniel also holds an MBA from University of Washington which has given him the education and expertise to run a business.

Financial Plan

Key Revenue & Costs

Pacific Blockchain will gain its revenues from mining bitcoin. Due to the nature of bitcoin, revenues are unpredictable. As of April 2023, every time we complete a block, we earn 6.25 BTC which is roughly valued around $177K. Even if we only solve a few blocks each year, Pacific Blockchain can be extremely profitable.

The primary cost drivers will include the cost of power consumption, the cost of equipment, employee salaries, and the lease.

Funding Requirements and Use of Funds

Pacific Blockchain is currently seeking $450,000 to launch. Funding will be dedicated towards three months of overhead costs to include payroll of the staff, rent, and marketing costs. Specifically, these funds will be used as follows:

- Location design/build: $50,000

- Equipment purchase and upkeep: $250,000

- Three months of overhead expenses (payroll, rent, utilities): $100,000

- Marketing costs: $25,000

- Working capital: $25,000

Download the Bitcoin Mining business plan template (including a customizable financial model) to your computer here <–

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Average yearly bitcoin mined: 12.5 BTC

- Current value per BTC: $28,300

Financial Projections

Income Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Bitcoin Mining Business Plan FAQs

What Is a Bitcoin Mining Business Plan?

A Bitcoin mining business plan is a plan to start and/or grow your Bitcoin mining business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

What are the Main Types of Bitcoin Mining Businesses?

There are a number of different kinds of Bitcoin mining businesses, some examples include: Bitcoin mining validation, Bitcoin mining validation and minting, and Mining Pools.

How Do You Get Funding for Your Bitcoin Mining Business Plan?

Bitcoin Mining businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Bitcoin Mining Business?

Starting a Bitcoin mining business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Bitcoin Mining Business Plan - The first step in starting a business is to create a detailed Bitcoin mining business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your Bitcoin mining business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your Bitcoin mining business is in compliance with local laws.

3. Register Your Bitcoin Mining Business - Once you have chosen a legal structure, the next step is to register your Bitcoin mining business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your Bitcoin mining business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Bitcoin Mining Equipment & Supplies - In order to start your Bitcoin mining business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your Bitcoin mining business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.