ATM Business Plan

You’ve come to the right place to create your ATM business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their ATM businesses.

Below is a template to help you create each section of your ATM business plan.

Executive Summary

Business Overview

SecureVault ATM Company is a startup ATM machine business located in Santa Cruz, California. The company is founded by Lacie Bryon, a vending machine manager who owns multiple machines throughout the city of Santa Cruz. She has built excellent relationships with the business owners from whom she rents space and electricity and, as a result, has several offers to place her ATM machines in the current locations where her name and reputation precedes her.

SecureVault ATM Company will provide reliable and secure ATM services to customers while creating mutually beneficial relationships with the location providers. There is an increased drive by consumers for cash and SecureVault ATM Company plans to build profit from that increase, particularly as the business grows. All SecureVault ATM machines will be in convenient and easily accessible locations, making it especially easy for consumers to access the ATM machines and return to it whenever needed.

Product Offering

The following are the services that SecureVault ATM Company will provide:

- Convenient and secure ATM cash withdrawals

- ATM cash machine services for tourists and out-of-country visitors

- Bank deposits that will transact within 24 hours

- Secure video panels and safety mechanisms within the machines ensure secure and safe transactions

- Proprietary app “ATM @My Location,” quickly sources and offers driving instructions to the nearest available ATM within the SecureVault ATM machines in the region

- Secure account information printouts with receipts

- Day to day management of ATM locations to maintain clean machines and surrounding areas

Customer Focus

SecureVault ATM Company will target residents of Santa Cruz. They will also target visitors from the U.S. and international visitors within the popular beach city. They will target business owners who are interested in partnerships built via the ATM machine locations. They will target businesses who will want to market services or products via the ATM app.

Management Team

SecureVault ATM Company will be owned and operated by Lacie Byron, a vending machine entrepreneur who owns multiple vending machines throughout the city of Santa Cruz. She has recruited her virtual assistant, Kayleigh Thompson, to join the startup on-site.

Lacie Byron has been a self-employed entrepreneur for over fifteen years. She has built excellent relationships with the business owners from whom she rents space and electricity and, as a result, has several offers to place her ATM machines in the current vending locations where her name and reputation precede her.

Kayleigh Thompson, the former virtual assistant, will join SecureVault ATM Company as an Administrative Assistant on-site. She will oversee all day-to-day administrative tasks. She will also be on-call for ATM emergencies 24/7 each day.

Success Factors

SecureVault ATM Company will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of SecureVault ATM Company

- Secure ATM machines that accept out-of-country debit and credit cards

- Proprietary app “ATM @My Location,” quickly sources and offers driving instructions to the nearest available ATM within the SecureVault ATM machines in the region

- Bank deposits that will transact within 24 hours

- SecureVault ATM Company creates partnerships with area businesses with the intention of building up both businesses and creating mutually beneficial profitability.

Download the ATM business plan template (including a customizable financial model) to your computer here <–

Financial Highlights

SecureVault ATM Company is seeking $200,000 in debt financing to launch its SecureVault ATM Company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

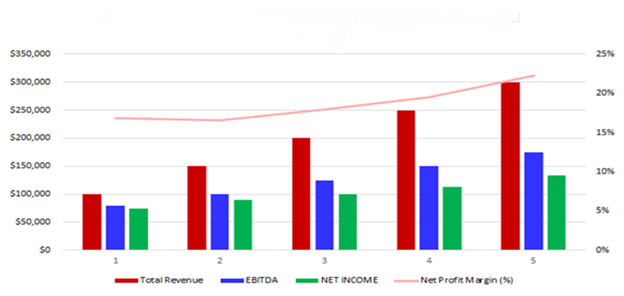

The following graph outlines the financial projections for SecureVault ATM Company.

Company Overview

Who is SecureVault ATM Company?

SecureVault ATM Company is a newly established, full-service ATM machine business in Santa Cruz, California. SecureVault ATM Company will be the most reliable, secure and convenient choice for residents, visitors and tourists from out of the country, as well as those from the surrounding communities. SecureVault ATM Company will provide a comprehensive menu of ATM choices and services for any customer to utilize. Their full-service approach includes a comprehensive set of options for cash withdrawals, deposits and other banking transactions.

SecureVault ATM Company will be able to serve hundreds of customers on a regular basis. The team of professionals in SecureVault ATM Company are highly qualified and experienced and each member of the team is trained to easily serve customers. SecureVault ATM Company removes all the headaches and issues of trying to find an ATM machine, particularly in an unfamiliar city, and ensures all issues are taken care of expeditiously while delivering the best customer service.

SecureVault ATM Company History

SecureVault ATM Company is owned and operated by Lacie Bryon, a vending machine

entrepreneur who operates multiple vending machines throughout the city of Santa Cruz. She has been in business for over 15 years and has built excellent relationships with the business owners from whom she rents space and electricity and, as a result, has several offers to place her ATM machines in the current locations where her name and reputation precede her.

Since incorporation, SecureVault ATM Company has achieved the following milestones:

- Registered SecureVault ATM Company, LLC to transact business in the state of California.

- Has a contract in place for a 10,000 square foot office in a midtown building.

- Reached out to numerous contacts to include SecureVault ATM Company in their current and future location plans.

- Began recruiting a staff of three and two office personnel to work at SecureVault ATM Company.

SecureVault ATM Company Services

The following will be the services SecureVault ATM Company will provide:

- Convenient and secure ATM cash withdrawals

- ATM cash machine services for tourists and out-of-country visitors

- Bank deposits that will transact within 24 hours

- Secure video panels and safety mechanisms within the machines ensure secure and safe transactions

- Proprietary app “ATM @My Location,” quickly sources and offers driving instructions to the nearest available ATM within the SecureVault ATM machines in the region

- Secure account information printouts with receipts

- Day to day management of ATM locations to maintain clean machines and surrounding areas

Industry Analysis

The ATM machine industry is expected to grow during the next five years to over $30 million.

The growth will be driven by ATM machines placed in new locations, particularly as new communities form.

The growth will also be driven by new industries or sectors that conduct business in rapidly-growing cities.

The growth will be driven by entrepreneurs who prefer to own and operate a business without an employer or oversight by others.

Costs will likely be reduced as ATM partnerships share the costs on a more equitable level of a 50/50 split.

Costs will also be reduced as new technology paves the way for improvements to ATM servicing capabilities.

Download the ATM business plan template (including a customizable financial model) to your computer here <–

Customer Analysis

Demographic Profile of Target Market

SecureVault ATM Company will target residents of Santa Cruz. They will also target visitors from the U.S. and international visitors within the popular beach city. They will target business owners who are interested in partnerships built via the ATM machine locations. They will target businesses who will want to market services or products via the ATM app.

The precise demographics for SecureVault ATM Company are:

| Total | Percent | |

|---|---|---|

| Total population | 1,680,988 | 100% |

| Male | 838,675 | 49.9% |

| Female | 842,313 | 50.1% |

| 20 to 24 years | 114,872 | 6.8% |

| 25 to 34 years | 273,588 | 16.3% |

| 35 to 44 years | 235,946 | 14.0% |

| 45 to 54 years | 210,256 | 12.5% |

| 55 to 59 years | 105,057 | 6.2% |

| 60 to 64 years | 87,484 | 5.2% |

| 65 to 74 years | 116,878 | 7.0% |

| 75 to 84 years | 52,524 | 3.1% |

Customer Segmentation

SecureVault ATM Company will primarily target the following customer profiles:

- Residents of Santa Cruz

- U.S. visitors and international tourists

- Potential business partners for ATM placement/services

- Potential business partners who will market their business via the ATM app

Competitive Analysis

Direct and Indirect Competitors

SecureVault ATM Company will face competition from other companies with similar business profiles. A description of each competitor company is below.

Quick Cash Company

Quick Cash Company provides ATM machine access throughout the Santa Cruz and Highway 1 Corridor. ATM machines are located within strip malls and adjacent to laundry facilities. The ATM machines provide cash in twenty-dollar increments up to a value of $200. The ATM machines do not accept bank deposits, nor do the ATMs accept cash deposits. There are no receipts provided.

Quick Cash Company is owned and operated by Gerrie and Sandy Doney, entrepreneurs who have been in the ATM business for over ten years. The ATM machines provided by Quick Cash Company are utilized heavily near the beach amusement park area and are also popular near the southern beach portion of the Santa Cruz city. Quick Cash Company has a singular goal: that of providing cash; all other transactions are omitted from the services provided.

MoneyLink ATM Services

MoneyLink ATM Services is bank-owned and operated as a convenience for the customers of the Redwood Bank. The day-to-day management of the ATM machines owned is contracted out to a security company that refills the ATM machines with cash on a regular basis and maintains the ATM machines as needed. The Redwood Bank provides services for customers of the bank, including conducting transactions if cash or checks are deposited and paying out up to $400 if the withdrawals are from a bank customer.

MoneyLink ATM Services operates 10 ATM machines in various parts of the city of Santa Cruz, with two ATM machines near tourist shops and mini-mall stores in the downtown area of the city. The ATM servicing company maintains the ATM machine by filling them with cash as needed; however there is no cleaning of the areas around the machines, nor cleaning of the machines themselves. There are no services offered at the ATM machines, other than withdrawals and deposits.

Harrison & Company

Harrison & Company is a legal limited liability company formed between four brothers who own and operate ATM and vending machines throughout the Santa Barbara, California area. They recently expanded their business to include Santa Cruz and other beach areas. There are twenty food vending machines in the business and 15 cash vending machines within the company, each serviced and maintained by the siblings in Harrison & Company.

The food vending machines owned by Harrison & Company are located primarily in strip malls and convenience stores, where visitors can access easy and convenient cash. Harrison & Company carefully evaluates each suggested location before placing a vending or ATM machine on any site, due to the increased risk of theft or other invasive tactics by unscrupulous visitors. Harrison & Company maintain the ATM machines and food vending machines on a daily basis and have created strong and lasting partnerships with other businesses in the area in order to secure the prime locations for their machines.

Download the ATM business plan template (including a customizable financial model) to your computer here <–

Competitive Advantage

SecureVault ATM Company will be able to offer the following advantages over their competition:

- Friendly, knowledgeable, and highly-qualified team of SecureVault ATM Company

- Secure ATM machines that accept out-of-country debit and credit cards

- Proprietary app “ATM @My Location,” quickly sources and offers driving instructions to the nearest available ATM within the SecureVault ATM machines in the region

- Bank deposits that will transact within 24 hours

- SecureVault ATM Company creates partnerships with area businesses with the intention of building up both businesses and creating mutually beneficial profitability

Marketing Plan

Brand & Value Proposition

SecureVault ATM Company will offer the unique value proposition to its clientele:

- Highly-qualified team of skilled employees who are able to provide a comprehensive array of services and cash products to consumers.

- Secure ATM machines that accept out-of-country debit and credit cards

- Proprietary app “ATM @My Location,” quickly sources and offers driving instructions to the nearest available ATM within the SecureVault ATM machines in the region

- Bank deposits that will transact within 24 hours

- SecureVault ATM Company offers reasonable partnership value and steady income levels for partners.

Promotions Strategy

The promotions strategy for SecureVault ATM Company is as follows:

Word of Mouth/Referrals

SecureVault ATM Company has built up an extensive list of contacts over the years by providing exceptional service and expertise to her clients. Current partners and potential partners are eager to take part in the relationships of SecureVault ATM Company and help spread the word of SecureVault ATM Company.

Digital Advertising

SecureVault ATM Company will contract with a digital marketing expert to access local and regional marketing campaigns.

Social Media Campaign

SecureVault ATM Company will also contract with a social media manager to announce the launch via a series of call outs across several channels to build up to the launch date. ATM locations and specifics of the services offered will be included in the social media campaign efforts.

Print Advertising

SecureVault ATM Company will secure local newspaper ads to announce the new ATM machines in the targeted communities and regional areas. They will also send a direct mail targeted flyer to all residents within Santa Cruz county.

Website/SEO Marketing

SecureVault ATM Company will fully utilize their website. The website will be well organized, informative, and list all the services and products that SecureVault ATM Company provides. The website will list their contact information and will engage in SEO marketing tactics so that anytime someone types in the Google or Bing search engine “ATM machine that accepts international debit and credit cards” or “ATM machine near me”, SecureVault ATM Company will be listed at the top of the search results.

Pricing

The pricing of SecureVault ATM Company will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for SecureVault ATM Company.

Operation Functions:

- Lacie Byron will be the Owner and President of the company. She will oversee all staff and manage partners and new partnership relations. She has spent the past year recruiting the following staff:

- Kayleigh Thompson, who will take on the role of Administrative Assistant and manage the office administration and act as the emergency contact.

Download the ATM business plan template (including a customizable financial model) to your computer here <–

Milestones:

SecureVault ATM Company will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel employment contracts for the SecureVault ATM Company

- 6/1/202X – Finalize contracts for SecureVault ATM Company partnerships

- 6/15/202X – Begin networking to find potential partners and ATM locations

- 6/22/202X – Begin moving into the SecureVault ATM Company office

- 7/1/202X – SecureVault ATM Company opens its office for business

Management Team

SecureVault ATM Company will be owned and operated by Lacie Byron, a vending machine entrepreneur who owns multiple vending machines throughout the city of Santa Cruz. She has recruited her virtual assistant, Kayleigh Thompson, to join the startup on-site.

Lacie Byron has been a self-employed entrepreneur for over fifteen years. She has built excellent relationships with the business owners from whom she rents space and electricity and, as a result, has several offers to place her ATM machines in the current vending locations where her name and reputation precede her.

Kayleigh Thompson, the former virtual assistant, will join SecureVault ATM Company as an Administrative Assistant on-site. She will oversee all day-to-day administrative tasks. She will also be on-call for ATM emergencies 24/7 each day.

Financial Plan

Key Revenue & Costs

The revenue drivers for SecureVault ATM Company are the fees they will charge to customers for the usage of their ATM services.

The cost drivers will be the overhead costs required in order to staff SecureVault ATM Company. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

SecureVault ATM Company is seeking $200,000 in debt financing to launch its ATM machine business. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and association memberships. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

Download the ATM business plan template (including a customizable financial model) to your computer here <–

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of ATM Customers Per Month: 1,600

- Average Revenue per Month: $56,500

- Office Lease per Year: $100,000

Financial Projections

Income Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

ATM Business Plan FAQs

What Is an ATM Business Plan?

An ATM business plan is a plan to start and/or grow your ATM business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your ATM business plan using our ATM Business Plan Template here.

What are the Main Types of ATM Businesses?

There are a number of different kinds of ATM businesses, some examples include: Independent ATM owner/operator, Mobile ATM, Bitcoin ATM, and ATM installation and maintenance.

How Do You Get Funding for Your ATM Business Plan?

ATM businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an ATM Business?

Starting an ATM business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An ATM Business Plan - The first step in starting a business is to create a detailed ATM business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your ATM business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your ATM business is in compliance with local laws.

3. Register Your ATM Business - Once you have chosen a legal structure, the next step is to register your ATM business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your ATM business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary ATM Equipment & Supplies - In order to start your ATM business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your ATM business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful ATM business: